About Fidelitydebitcard.com

This company does not currently have a business account, if you are the owner of the company, you can open a business account immediately.

Site Information

Is this your company?

Claim your profile to access Trustedreviews free business tools and start getting closer to your customers today!

About TrustedReviews

We Fight Fake Reviews

Here’s how you can flag problematic reviews.

We improve experiences

Here's our commitment to you.

We encourage quality customer feedback

We are check comments and we care about data reliability

Business Transparency

Claiming a profile allows the company to do things like reply to reviews, invite customers to write reviews,

Dear users; You can find all kinds of information about TrustedReviews in the faq section.

The Fidelity Debit Card is a credit card that is available to those who have a Fidelity account. The card offers you a variety of features and is available to you through Fidelity Mobile. If you have an HSA, you can even have the card set up on your behalf.

If you have a Fidelity Cash Management Account, you'll be happy to learn that your ATM withdrawal fees will be waived. However, you should make sure you're aware of some important facts.

First, the Fidelity Cash Management Account is subject to the FDIC Disclosure Document. You can review this document online or at a bank branch. The disclosure explains the types of funds you can deposit, and the time it takes for them to be made available.

Second, the Fidelity Cash Management Account also has a higher level of FDIC insurance than a regular checking account. As with any type of savings or checking account, you may lose some or all of your money if the bank or the branch becomes insolvent. Fortunately, the Bank will reimburse you for any ATM withdrawal fees you've incurred from other institutions.

If you have a Fidelity Bank debit card, you can access debit card features from the Fidelity Mobile Banking App. This app is available for Android and iPhone. It includes the ability to transfer funds, set spending limits, and manage debit cards. You can also deposit checks using your smartphone.

The Fidelity Bank app offers users a mobile wallet for quick and secure payments. In addition to this, users can set alerts for debit card purchases and fraudulent transactions.

When you're ready to make a purchase with your debit card, you can enter a passcode that includes an uppercase and lowercase alpha character. Be sure to protect your passcode, and never give your PIN to a stranger.

Another feature of the Fidelity Mobile Banking app is the ability to set travel preferences. This lets you control your debit card usage based on where you are traveling. Whether you're traveling on business or vacationing, you can set your spending limits and turn your card on or off.

If you own a Fidelity debit card, you're probably aware of its daily transaction limits. These limits are in place to avoid theft and preserve your bank's reserves. However, these limits are not the only thing you need to know about your fidelity card. You also need to know about its online features and the various tools available to you.

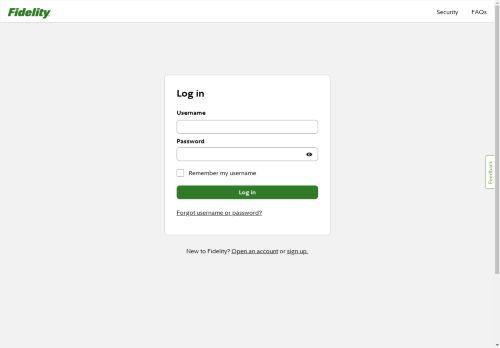

To figure out what your daily limit is, you need to login to your online account. The limit is subject to your available balance, your personal profile, and other factors. Your bank may also offer you the opportunity to increase your daily limits by contacting them.

Similarly, you may need to call your bank to find out the best way to contact them, including the best time to do so. If you do not have access to an online account, the simplest way is to visit your local branch.

When it comes to managing savings or investments abroad, a Fidelity debit card is a great choice. This is because it can be used for purchases in Europe. And the best part is that you can get your money back at an ATM.

Fidelity offers both a debit card and a brokerage account. With their debit card you can make purchases without the usual fees, and with the account you can access your investment accounts. It is also possible to link external accounts to the account to expand your financial capabilities.

A Fidelity debit card is free to use, and you can get reimbursed for out of network transactions. There are also no fees for using the card at the ATM. However, the limit on the amount of cash you can withdraw from an ATM is fairly low. The daily limits are set by the bank, and you can check the details before you walk out of the door.

If you want to open a health savings account, you can start by visiting the Fidelity site. You will need to provide your Social Security number to set up an account. Also, you may have to verify your birth date.

Once you have an account, you can deposit money. The funds can be used for day-to-day medical expenses or used for savings. They can be used tax-free. Investing the funds can also help reduce health care costs for retirement.

The Fidelity website has information on all the features available. It allows you to view your current balance, interest earnings, and deposit activity. You can also see your daily spending and withdrawal limits.

You can lock your Fidelity debit card online. This feature prevents you from making new purchases, but it does not affect your credit.